Commodity intelligence plays a crucial role in the shipping industry as it provides valuable insights and data that help stakeholders make informed decisions and optimize their operations. At ChartDesk, we think commodity intelligence refers to the collection, analysis, and dissemination of information related to commodities, including supply and demand dynamics, pricing trends, trade volumes, and market conditions.

In the context of the shipping industry, commodity intelligence is used in several ways:

1. Cargo Planning and Optimization

Shipping companies and freight forwarders use commodity intelligence to identify trends in commodity movements and demand patterns. This helps them plan their vessel routes and cargo capacity allocation efficiently, ensuring optimal utilization of resources and maximizing profitability.

2. Freight Rate Forecasting

Commodity intelligence provides data on commodity price fluctuations, which impact freight rates. Shipping companies and traders use this information to predict and adjust freight rates, ensuring competitive pricing and profitability.

3. Risk Management

Understanding commodity market dynamics allows shipping companies to manage risks associated with cargo volumes, pricing, and market volatility. This knowledge helps them develop effective risk management strategies and hedging mechanisms.

4. Market Analysis and Market Entry

Commodity intelligence helps shipping companies identify emerging markets and potential new trade routes. Armed with this data, companies can make informed decisions on expanding their services to new regions.

5. Chartering Decisions

Ship owners and charterers use commodity intelligence to assess market conditions and determine whether to charter a vessel or sell it. This information is critical in making strategic decisions regarding vessel deployment and utilization.

6. Investment Decisions

Investors in the shipping industry, such as private equity firms and financial institutions, rely on commodity intelligence to evaluate market opportunities and make informed investment decisions.

7. Compliance and Regulatory Considerations

Understanding commodity trade flows and associated regulations helps shipping companies ensure compliance with international trade laws and shipping regulations.

8. Environmental Impact Assessment

Commodity intelligence also plays a role in assessing the environmental impact of commodity movements and trade. This information aids in optimizing shipping routes to minimize emissions and reduce the industry’s carbon footprint.

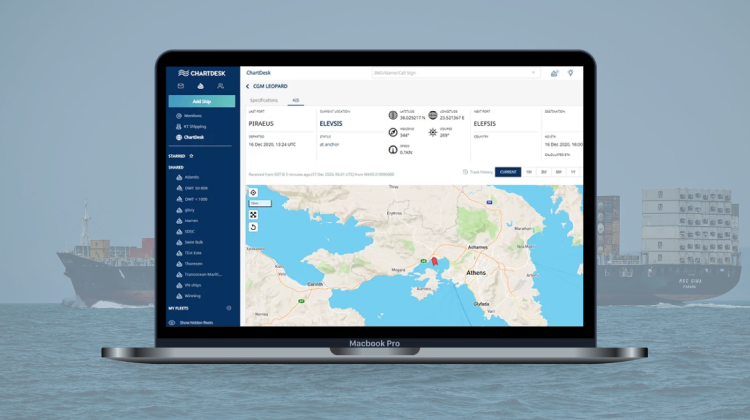

About ChartDesk

ChartDesk shared mailboxes are virtual mailboxes that allow multiple people to access, view, and manage emails from a single account. This feature enables teams to collaborate more easily, as they can all access the same emails and reply to them as needed. ChartDesk shared mailboxes also provide users with a more secure way to store and share email data, as all emails are encrypted before they are sent. ChartDesk is on the Cloud.

Leave a reply